The 4-Minute Rule for Amur Capital Management Corporation

The 4-Minute Rule for Amur Capital Management Corporation

Blog Article

A Biased View of Amur Capital Management Corporation

Table of ContentsThe Single Strategy To Use For Amur Capital Management Corporation10 Simple Techniques For Amur Capital Management CorporationNot known Details About Amur Capital Management Corporation The Buzz on Amur Capital Management CorporationAmur Capital Management Corporation Fundamentals ExplainedUnknown Facts About Amur Capital Management CorporationExcitement About Amur Capital Management Corporation

A low P/E ratio may show that a firm is undervalued, or that investors anticipate the business to deal with harder times in advance. What is the perfect P/E ratio? There's no best number. Nevertheless, financiers can make use of the average P/E ratio of other business in the same industry to form a baseline.

The Ultimate Guide To Amur Capital Management Corporation

The standard in the automobile and truck market is just 15. A stock's P/E proportion is easy to locate on a lot of financial reporting web sites. This number indicates the volatility of a supply in contrast to the market all at once. A security with a beta of 1 will exhibit volatility that corresponds that of the market.

A supply with a beta of above 1 is in theory much more unpredictable than the market. As an example, a safety with a beta of 1.3 is 30% more unstable than the marketplace. If the S&P 500 increases 5%, a stock with a beta of 1. https://urlscan.io/result/da8cd069-a27f-4f4d-b2c3-84502a3135af/.3 can be anticipated to rise by 8%

About Amur Capital Management Corporation

EPS is a dollar figure standing for the section of a firm's earnings, after tax obligations and recommended stock dividends, that is allocated to each share of usual stock. Financiers can use this number to evaluate how well a firm can supply worth to shareholders. A greater EPS results in higher share rates.

If a business regularly falls short to provide on revenues projections, an investor might wish to reconsider acquiring the stock - exempt market dealer. The estimation is easy. If a company has an earnings of $40 million and pays $4 million in returns, then the continuing to be sum of $36 million is split by the number of shares outstanding

Getting My Amur Capital Management Corporation To Work

Financiers often get interested in a stock after reading headings concerning its incredible performance. An appearance at the fad in rates over the previous 52 weeks at the least is essential to get a sense of where a stock's rate may go following.

Let's look at what these terms suggest, how they vary and which one is ideal for the ordinary capitalist. Technical analysts brush via substantial volumes of data in an initiative to anticipate the instructions of supply prices. The information is composed mostly of past pricing info and trading that site volume. Fundamental evaluation fits the requirements of many financiers and has the advantage of making great feeling in the real life.

They believe rates comply with a pattern, and if they can figure out the pattern they can profit from it with well-timed professions. In current decades, modern technology has actually made it possible for more capitalists to exercise this design of spending because the tools and the data are a lot more available than ever before. Essential experts take into consideration the inherent value of a stock.

Amur Capital Management Corporation for Beginners

A number of the concepts went over throughout this piece are common in the basic analyst's world. Technical analysis is finest suited to someone who has the time and convenience degree with data to put infinite numbers to make use of. Otherwise, essential evaluation will fit the demands of most capitalists, and it has the benefit of making great feeling in the real life.

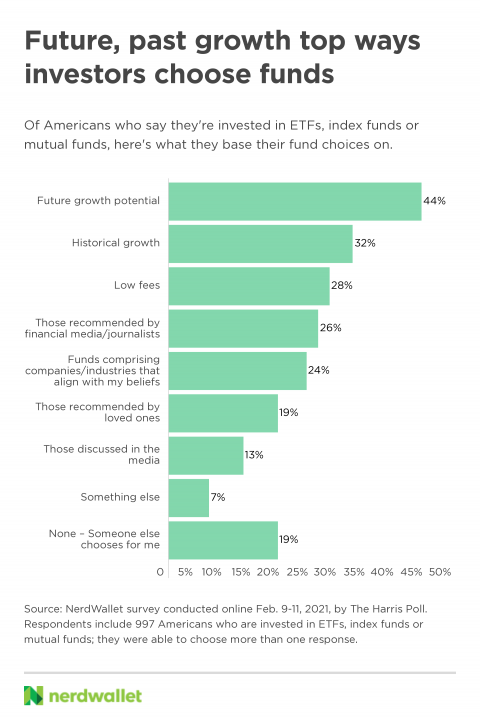

Brokerage charges and common fund expenditure proportions draw cash from your profile. Those expenditures cost you today and in the future. For example, over a period of 20 years, yearly charges of 0.50% on a $100,000 investment will certainly decrease the portfolio's value by $10,000. Over the same period, a 1% fee will reduce the very same profile by $30,000.

The fad is with you. Many mutual fund firms and on-line brokers are decreasing their fees in order to contend for customers. Capitalize on the trend and look around for the most affordable cost.

Little Known Questions About Amur Capital Management Corporation.

, green room, picturesque views, and the community's condition factor plainly right into household property appraisals. A vital when taking into consideration property area is the mid-to-long-term view relating to just how the location is anticipated to progress over the investment duration.

Amur Capital Management Corporation for Dummies

Thoroughly review the ownership and desired use of the immediate locations where you intend to spend. One way to accumulate info regarding the prospects of the vicinity of the property you are considering is to contact the city center or various other public agencies in charge of zoning and urban preparation.

This uses normal revenue and long-lasting value gratitude. The temperament to be a property owner is required to take care of feasible conflicts and legal problems, handle occupants, repair work, etc. This is generally for quick, little to tool profitthe typical building is unfinished and cost a profit on conclusion.

Report this page